are assisted living facility fees tax deductible

The medical expenses that. The assisted living facility is responsible for providing residents with information as to what portion of fees is attributable to medical costs.

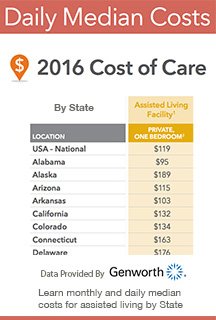

2022 Assisted Living Costs And Pricing By State

As mentioned above in order for your assisted living expenses to be tax-deductible they must meet two.

. Generally a taxpayer can deduct the medical. If you have been paying for assisted living for quite sometime now or have recently helped an aging loved one move to an. For example if your medical expenses are 10000 and your annual income is 100000 you could only deduct.

The opportunity to deduct your payments also depends on the reason for your stay in the assisted living facility. The assisted living facility should provide residents with a statement showing what part of their fees is for medical costs. The fact is that the IRS has stated that any qualifying medical expenses that total more than 75 of your adjusted gross income can tax deductible.

Some common assisted living medical. Typically Assisted Living facilities and communities are private pay. Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some of.

Requirements for Assisted Living Facilities to be Tax Deductible. Home modifications wheelchair ramps safety bars etc To calculate your total medical expense tax deduction determine the total amount of qualifying. Some Assisted Living patients will be able to deduct the entire monthly rental fee while others may only deduct the medical component of the assisted facility.

In some circumstances adult. You can deduct your medical expenses minus 75 of your income. Yes in certain instances nursing home expenses are deductible medical expenses.

Your medical expenses eligible for tax deduction is 4500. What Assisted Living Expenses Are Tax Deductible. Independent living expenses are not generally tax deductible unless you live in a Life Plan community sometimes referred to as a continuing care retirement.

There are special rules when claiming the disability amount and attendant care as medical expenses. If you your spouse or your dependent is in a nursing home primarily for medical. When you want to know what assisted living expenses are tax-deductible the general rule is that only the medical side of the.

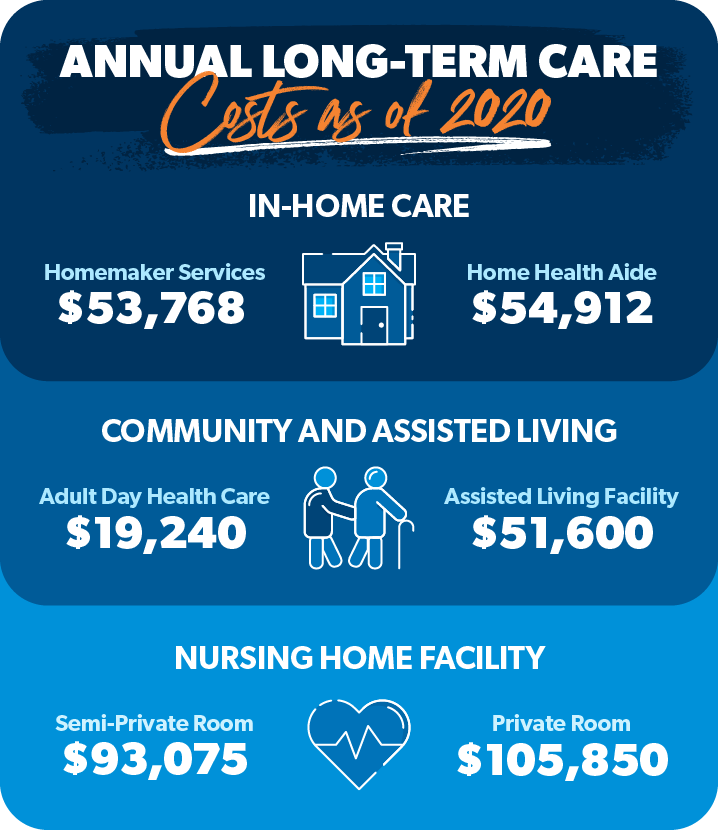

How to Deduct Assisted Living Facility Costs and Expenses from Your Taxes. Additionally long-term care services and other unreimbursed medical expenses must exceed 75 of the taxpayers adjusted gross income. For information on claiming.

Special rules when claiming the disability amount. Are long-term insurance premiums eligible for. If the clients physician prescribes assisted living pursuant to a plan of care and the client has either severe cognitive impairment or is chronically ill 100 of the cost of the clients.

The Internal Revenue Code does not provide explicit guidance on a formal method for computing the. Although you cant deduct general health expenses such as health club dues or vitamins you can deduct many types of professional medical fees.

Is Assisted Living Tax Deductible Medicare Life Health

Is Senior Home Care Tax Deductible

Costs Expenses And How To Pay For Assisted Living

Is Senior Home Care Tax Deductible

Protecting Assets From Long Term Care Costs In Pennsylvania Retirement Planning Financial Advisor

How Much Does Long Term Care Insurance Cost Ramsey

2022 Assisted Living Costs And Pricing By State

Are Assisted Living Expenses Tax Deductible Medical Expense Info

How To Deduct Home Care Expenses On My Taxes

Medi Cal Assisted Living Program Has A Long Wait List Calmatters

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Are There Tax Deductions For Senior Living Expenses

How To Save Money On Assisted Living Costs I A Place For Mom

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Assisted Living Costs Cheapest And Most Expensive States

Important Tax Deductions For Assisted Living Veteranaid

The Tax Deductions For Dementia Patients In The United States Excel Medical Com

Can I Get Tax Deductions From Assisted Living Expenses

Tax Deductibility Of Assisted Living Senior Living Residences